The combined LTV proportion measures up the balance of your financial and you can your own HELOC along with your house’s worthy of. If your residence is respected during the $150,one hundred thousand therefore are obligated to pay $75,100 on your own financial, while wanted an effective $30,100000 HELOC, who does leave you a mixed LTV out-of 70% ($75,100000 + $31,000 = $105,one hundred thousand, that is 70% regarding $150,000). If the credit rating is gloomier, you ount.

Refinancing mortgage

Refinancing mortgage occurs when your alter your most recent home loan having a beneficial brand new one. Property owners may refinance adjust the regards to its home loan otherwise to take out dollars.

Can you imagine you owe $75,100000 on your own mortgage along with your residence is worthy of $150,000. You have two options for refinancing. When you need to lower your monthly mortgage payments, you can refinance their $75,100 equilibrium which have an effective $75,one hundred thousand 30-season fixed-rate financial. Should you want to accessibility the your house equity, you can refinance with a beneficial $one hundred,100000 29-seasons repaired-rates home loan. Within closure, you might discovered $25,100000.

Profile has the benefit of 31-seasons fixed-rates financial refinances. Consequently the loan was paid over 30 years along with your interest rate never ever change. It means the fee usually stays a similar. However, this won’t tend to be escrow money to own taxes and you will insurance, that could alter.

Average Weeks to close off Mortgage

Shape HELOC has the benefit of closings when you look at the just 5 days. You can complete the initially software online in approximately 5-ten minutes, and you may generally learn straight away whether or not you’ve been recognized. Getting Mortgage Refinance, you can finish the 1st app on the web in approximately ten minutes and certainly will close in a point of days.

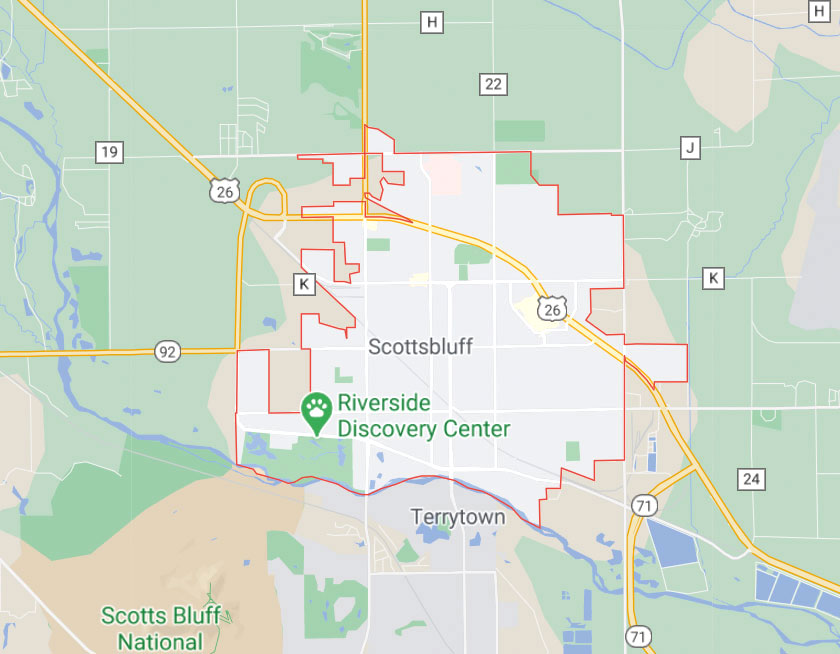

To have HELOCs, Contour uses an automatic Valuation Design (AVM) to evaluate the property’s worth so that you won’t need to wait to own a call at-person appraisal. It bases its decision towards the equivalent transformation, public analysis suggestions and you may manner on your regional housing marketplace. To have mortgage refinances, Figure will work with you so you can plan a call at-individual assessment plus people inspections.

Once you’ve already been recognized, quite a few of Figure’s HELOC subscribers can work with one of their eNotaries. The eNotary verifies their label and you will ratings your write-ups to you, which you’ll signal electronically. Not all areas make it eNotaries, but not. In this case, Contour are working with you to prepare an in-people notary conference.

To have mortgage re-finance, Profile works together one agenda an in-individual closing home or an area that you choose, according to what is actually greet your area.

Figure Credit history Minimum

Your credit rating is actually a good step 3-thumb count you to summarizes how well you pay straight back obligations. Ratings vary from 3 hundred to 850, and you will a get from 700 or more is known as good. Loan providers routinely have at least credit rating. If you’re below the monthly installment loans Atlanta GA minimal, you’ll need to take some time to change their get prior to you can be eligible for that loan.

Figure’s credit history minimum having mortgage refinances are 620. Its credit rating lowest having HELOCs was 640 (720 getting Oklahoma for both factors).

Contour has financial obligation-to-money (DTI) proportion conditions. Their DTI ratio measures up the month-to-month loans costs into pre-tax money. Can you imagine you will be making $5,one hundred thousand monthly just before taxation and you have $2,100 four weeks for the monthly debt costs, which includes your mortgage payment, the new Contour mortgage percentage, credit card repayments, vehicle payments and you may student loan money. Thus giving you a beneficial 40% DTI ratio.

Contour need those people obtaining good HELOC getting a beneficial DTI ratio out-of fifty% otherwise reduced, and perhaps, you want a beneficial DTI proportion away from 43% or shorter. Getting refinancing a mortgage, you need good DTI ratio off 43% or less.

Leave a Reply